Research Reports

Raise Trucking Insurance Minimums to Raise Safety

May 2021Highlights

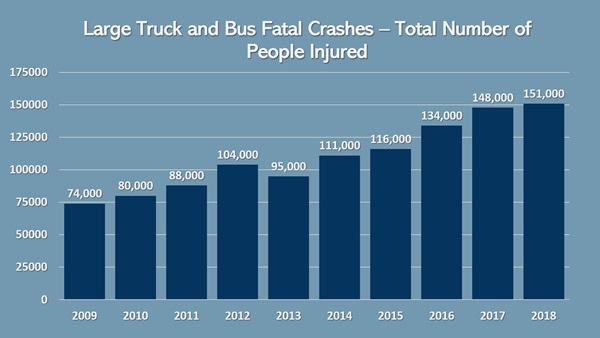

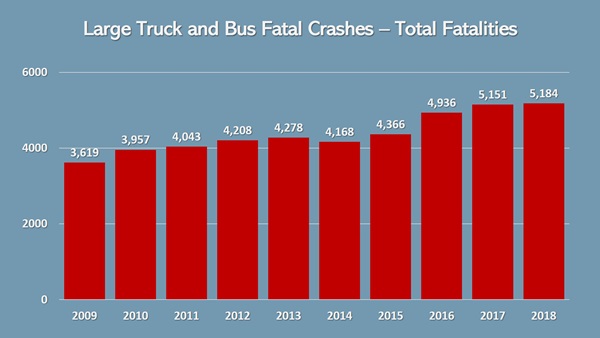

- The rate of truck crashes and fatalities has more than doubled over the last 10 years.

- The minimum levels of insurance were set in 1980, have not changed in 41 years, and are now completely inadequate.

- Trucking insurance is decreasing in cost and makes up only around 4% of operating costs.

- Raising insurance minimums will not only better compensate crash victims but also allow insurance to function properly and provide an economic incentive for companies to operate safely.

According to the Federal Motor Carrier Safety Administration (FMCSA), the rate of truck crashes and fatalities has more than doubled over the last 10 years. In 2018, the most recent year for which data are available, over 150,000 people were injured in truck crashes and over 5,000 were killed.1

Not surprisingly, the vast majority of people killed in crashes involving trucks are the occupants of cars that are hit. A passenger in a vehicle that collides with a truck is four times more likely to die than the truck driver.2 Those injured, and the families of those killed, are frequently confronted with more misfortune after a crash. Minimum insurance levels for trucks have not been raised since 1980 and frequently do not provide enough compensation to cover medical bills and other costs.

Reagan-Era Minimum Insurance Levels

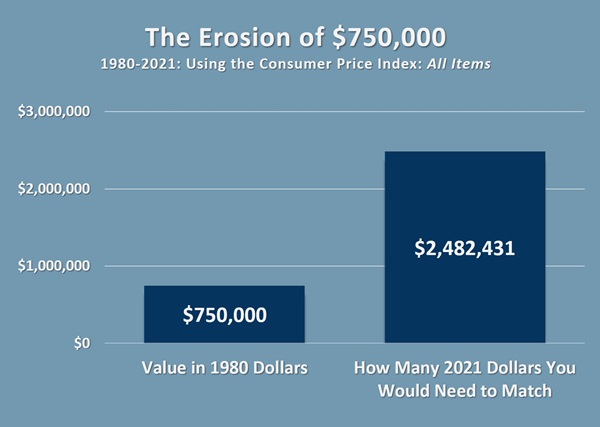

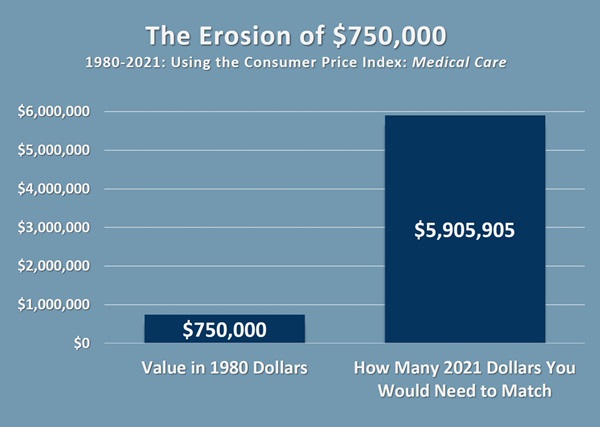

A fatal truck crash costs about $4.9 million in direct costs.3 The FMCSA requires that carriers only carry insurance of $750,000 per incident. This unrealistically low level of insurance is a leftover from the Reagan era, has not changed in 41 years, and has not been adjusted for inflation, even though many crashes exceed these limits.

The minimum levels of insurance were set in 1980. The average cost of a car was just $7,500 and the average house just $47,000.4

These archaic insurance limits are dramatically unjust. The $750,000 basic minimum liability requirement of 1980 is now worth approximately $230,000. You would need $2.5 million in today’s dollars to equal the basic minimum liability requirement of 1980.

Taking into account medical costs makes the 1980 minimums look even more inadequate. Adjusting for medical care inflation, you would need $5.9 million to equal the minimum liability requirements put in place more than 40 years ago.

The Surprising Economics of Trucking

In 2019, the trucking industry generated $792 billion in revenue, more than the insurance or commercial banking industries and even greater than the GDP of Saudi Arabia.5 The cost of insurance for all these trucks is frequently cited by the industry as the reason why minimum insurance limits should not be raised. However, insurance is a surprisingly small portion of operating costs and is getting cheaper.

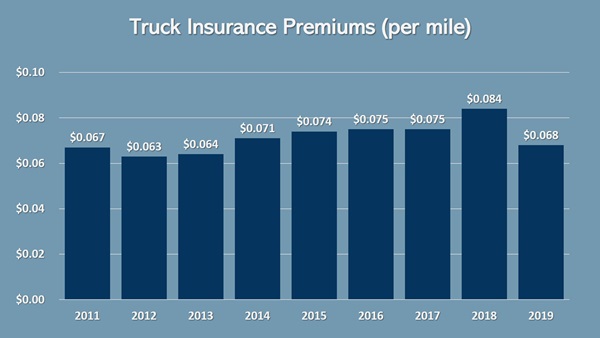

The average truck insurance premium amounts to less than seven cents per mile—the lowest rate over the last six years.6

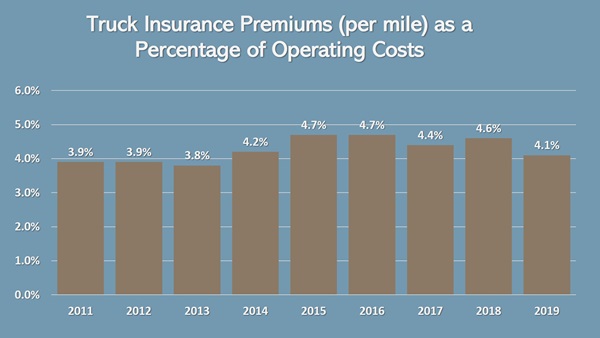

Total insurance outlays comprise just 4% of total operating costs— again the lowest rate over the last six years.7

Insurance might thus be comparatively cheap for trucking companies—they spend six times as much on fuel for instance—but not necessarily for other drivers.8 Just the presence of trucks on the road increases the dangers to other road users and increases their insurance premiums.

While trucks comprise approximately 5% of registered vehicles on the road, truck crashes account for nearly 16% of all crash fatalities.9 What’s more, research also shows that, by making roads less safe, just the presence of trucks increases non-truck accidents by 2%.10 That causes insurance premiums for passenger vehicle drivers to increase by as much as $50 per year.11

Society also bears the cost of truck crashes in more acute ways. The $750,000 policy minimum applies to the entire crash—not each party injured or killed. When trucks kill or injure other road users—particularly when multiple people are killed or injured—the $750,000 policy minimum is far too inadequate to pay for all parties’ medical bills, which often forces the burden on entities such as Medicare, and thus on taxpayers.12

The Societal Value of Raising Insurance Minimums

Raising minimum levels of insurance does not just offer crash victims a better chance of having their medical bills and other costs covered. It also has the effect of making trucks safer.

Currently, insurance is so cheap—because minimum levels are so low—that there is no economic incentive to improve safety. In other areas of insurance, such as passenger vehicles, the safer you drive, the lower your premiums will be. Individuals or companies that operate recklessly find themselves facing higher premiums or unable to obtain insurance at all. In the trucking world, the insurance market itself is unable to function properly—offering lower premiums to safe companies and higher premiums to companies with dangerous histories—because outdated minimum insurance levels keep premiums artificially low for even the most dangerous companies.

Companies with large trucking fleets tend to insure themselves at far greater levels than the mandated minimum because it makes economic sense—they want insurance to cover their costs and not leave them picking up the excess costs caused by a crash. However, 90% of trucking companies operate six trucks or less, and these smaller companies are notorious for operating with bare minimum levels of insurance.13 Faced with paying damages from a truck crash, these companies frequently close down and then “reincarnate” with a different name. The FMCSA has long battled these so-called “chameleon” companies, but they have proven nearly impossible to stop.14

Regulators are therefore faced with an impossible task. With more than 15 million trucks on the road, an economic model that encourages risk-taking, and a vast number of constantly shifting chameleon companies, inspecting authorities must deal with a “needle in a haystack” scenario. There are simply too many dangers to catch.

Conclusion

The danger posed by large trucks is increasing while the compensation for those killed or injured is shrinking or effectively disappearing. Truck drivers are pushed to ignore safety measures, delay repairs, and drive in a fatigued state. Regulators are overwhelmed because there are simply too many dangers for inspectors to catch. Archaic insurance rules have undermined the economic incentives to safety.

Civil justice is vital in holding negligent trucking companies accountable and providing compensation to those killed or injured by unsafe trucks. However, without a properly functioning insurance system, negligent trucking companies are too often able to continue operating, and the dead and injured are left without recourse.

Fundamental, market-based change is needed if thousands of innocent people are not to die in vain, and that starts by raising minimum levels of insurance.

Download the Full Report (PDF)

- Large Truck and Bus Crash Facts 2018, Federal Motor Carrier Safety Administration (FMCSA), 2020, https://www.fmcsa.dot.gov/safety/data-and-statistics/large-truck-and-bus-crash-facts-2018.

- Large Trucks, Injury Facts, 2019, https://injuryfacts.nsc.org/motor-vehicle/road-users/large-trucks/#:~:text=A%20total%20of%205%2C005%20people,pedestrians%20and%20bicyclists%20

- FMCSA’s estimate of 2005 costs is here adjusted for inflation to 2021 dollars - Unit Costs of Medium and Heavy Truck Crashes, Federal Motor Carrier Safety Administration (FMCSA), March 2007, https://web.archive.org/web/20100527084531/http://mcsac.fmcsa.dot.gov/documents/Dec09/UnitCostsTruck%20Crashes2007.pdf.

- Cost Of a Car In The Year You Were Born, Chron, April 19, 2016, https://blog.chron.com/carsandtrucks/2016/04/cost-of-a-car-in-the-year-you-were-born/; Here’s how much housing prices have skyrocketed over the last 50 years, CNBC, June 23, 2017, https://www.cnbc.com/2017/06/23/how-much-housing-prices-have-risen-since-1940.html.

- ATA American Trucking Trends 2020, American Trucking Associations (ATA), 2020, https://www.trucking.org/economics-and-industry-data; Biggest Industries by Revenue in the US in 2021, IBIS World, 2021, https://www.ibisworld.com/united-states/industry-trends/biggest-industriesby-revenue/; Gross Domestic Product 2019, World Bank, https://databank.worldbank.org/data/download/GDP.pdf.

- An Analysis of the Operational Costs of Trucking: 2020 Update, American Transportation Research Institute, November 2020.

- An Analysis of the Operational Costs of Trucking: 2020 Update, American Transportation Research Institute, November 2020.

- An Analysis of the Operational Costs of Trucking: 2020 Update, American Transportation Research Institute, November 2020.

- Large Trucks and Buses by the Numbers, Federal Motor Carrier Safety Administration (FMCSA), 2019, https://www.fmcsa.dot.gov/ourroads/large-trucks-and-buses-numbers; Highway Statistics 2018, Department of Transportation – Federal Highway Administration, 2021, https://www.fhwa.dot.gov/policyinformation/statistics/2018/mv1.cfm.

- The Accident Externality from Trucking, National Bureau of Economic Research (NBER), 2017, https://www.nber.org/papers/w23791.

- The Accident Externality from Trucking, National Bureau of Economic Research (NBER), 2017, https://www.nber.org/papers/w23791.

- The economic and societal impact of motor vehicle crashes, 2010. (Revised) (Report No. DOT HS 812 013). Washington, DC: National Highway Traffic Safety Administration, https://crashstats.nhtsa.dot.gov/Api/Public/ViewPublication/812013.

- Economics and Industry Data, American Trucking Associations (ATA), 2020, https://www.trucking.org/economics-and-industry-data; Minimum Insurance Levels for Motor Carriers, Truck Safety Coalition, https://trucksafety.org/minimum-insurance-levels-motor-carriers/.

- What Are Chameleon Carriers and Why Are They Dangerous? Trucks.com, September 14, 2015, https://www.trucks.com/2015/09/24/what-is-a-chameleon-carrier-and-why-are-theydangerous/.

Contact AAJ Communications by phone at 202.684.9588 or email media.replies@justice.org. Contact Us

AAJ protects the constitutional right to a trial by jury and safeguards the right to pursue justice in court for harms caused by the negligence or misconduct of others.

Learn MoreA community of trial lawyers committed to supporting those who represent individuals and families who have been hurt or killed in trucking crashes.

Learn More